PROTECT YOUR LEGACY.

Today, Tomorrow & Beyond.

Protect your income and financial stability with clear, unbiased disability insurance guidance.

Your ability to earn a living is one of your greatest assets. If an illness or injury left you unable to work, disability income insurance provides the steady financial support you need to stay on top of everyday expenses while you recover. It’s a simple, affordable way to protect your stability—and your peace of mind.

Affordable, customizable coverage that pays you a weekly benefit.

Choose how long you get paid while you're totally disabled, & how long you wait for the 1st payment.

Keep your insurance if you change jobs or retire prior to age 65.

Easy application and fast approvals with no medical exams for most.

Optional coverage for stay-at-home parents!

Individual Disability Income Insurance

I am self-employed, so I can't get disability insurance, right?

WRONG!!! We've got individual disability income solutions for EVERYONE, such as self-employed, freelancers, 9 to 5 workers, and anything in between, we've got you covered!

I am a stay-at-home mom/dad, what's available for me?

Being a stay-at-home parent is an important job! And we've got optional coverage for you too! Contact us to find out more!

What is an elimination period?

The number of consecutive days one must be totally disabled before they become eligible for benefits – a longer elimination period lowers the cost of coverage, and vice versa.

What is Own-Occupation Definition of Disability?

This is defined as the inability to work at the insured’s regular occupation at the time disability begins, even if the insured still might be able to work at another occupation.

What is Total Disability?

A sickness or injury is considered a total disability if it keeps you from doing all the substantial and material duties of your regular job and requires a physician’s care during the benefit period.

How much coverage do I need?

Income Protection is meant to keep enough money flowing into your household if you’re disabled & unable to work, so it’s important to look at your expenses & determine how much you’ll need for replacement. If the disability becomes long term, planning for things like retirement, future living expenses & children’s education expenses is essential.

How much does it cost?

Income Protection can cost as little as one percent of your income. It’s hard to think about insurance versus all those other things you buy. But protecting your income helps you live your best life in the long run.

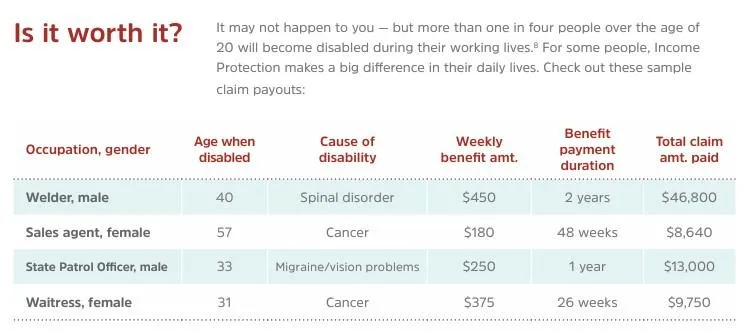

Is it worth it?

It may not happen to you — but more than one in four people over the age of 20 will become disabled during their working lives. For some people, Income Protection makes a big difference in their daily lives.

READY WHEN YOU ARE

Your Health & legacy matters. Let’s protect it—together.

Why Choose Core Legacy Group?

Choosing a plan—whether for your health, Medicare, or your estate—isn’t just about forms—it’s about trust. At Core Legacy Group, we don’t just handle paperwork; we guide you through some of the most important decisions you’ll ever make for yourself and your loved ones.

You’re not rushed. You’re heard.

We’ve seen firsthand the confusion and stress that comes with planning for your health, Medicare, and your family’s future. That’s why our approach is different—personal, guided, and centered around you.

The Core Legacy Difference

Compassion-led guidance

Licensed, trusted professionals

Clear, personalized solutions

Education—not pressure

Choosing Core Legacy Group means choosing clarity today—and peace of mind for the people you love tomorrow.

Medicare Disclaimer:

Core Legacy Group and its licensed agents are independent insurance agents. We do not represent or are endorsed by the federal government or the Medicare program. We offer products from multiple insurance carriers. This website is for informational purposes only and is not a solicitation to enroll in a Medicare plan. For official Medicare information, visit www.medicare.gov.