PROTECT YOUR LEGACY.

Today, Tomorrow & Beyond.

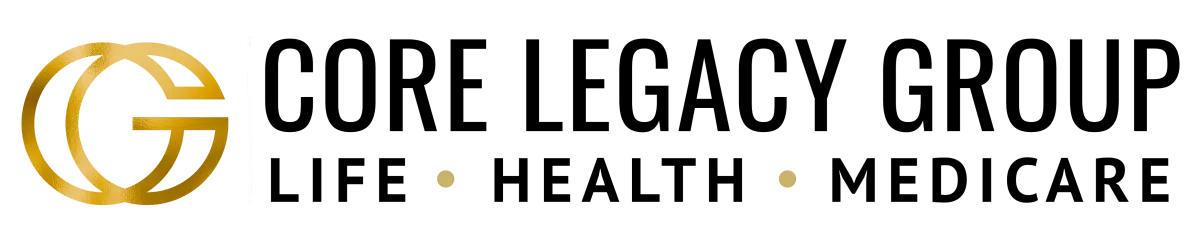

Medicare is divided into 4 Parts, and we often hear this is very confusing!

Why are there so many parts? What do these parts mean? What parts do I need?

We're going to break down the parts of Medicare and make it simple for you!

Medicare Part A

Part A is your hospital insurance. This helps cover costs associated with inpatient hospitalization, home health care, skilled nursing, hospice and blood services (covers blood transfusions beyond the first 3 pints of blood).

For most people, Part A premiums start at $0/month as long as they have at least 10 years of qualifying work credits or married to someone who is at least 62 years old and has qualifying work credits. Additionally, certain individuals with disabilities may also be eligible for Part A. If you're unsure, please use the Medicare Eligibility Tool or simply give us a call at 386-378-1696, we would be happy to help!

How to enroll: You enroll into Parts A & B through the Social Security office, or Railroad Retirement Board.

There is no yearly limit on annual out of pocket costs. Medicare pays 80% and you are responsible for the remaining 20%.

Medicare Part B

Part B is coverage for outpatient services, such as office visits, chemotherapy, radiation, surgeries, testing & supplies. Many of these services can occur in a hospital, but they are covered under Medicare Part B.

Medicare Part A & Medicare Part B are collectively known as "Original Medicare".

How to enroll: You enroll into Parts A & B through the Social Security office, or Railroad Retirement Board.

For most people, Part B premiums for 2026 start at $202.90/month.

There is no yearly limit on annual out of pocket costs. Medicare pays 80% and you are responsible for the remaining 20%.

Medicare Part C

Medicare Part C can be a little confusing and is often referred to as a Medicare Advantage Plan, which is offered through private insurance companies.

Perhaps one of the most appealing key points of Medicare Advantage Plans is they include Part A, Part B and sometimes Part D, all from the same insurance carrier. These plans include a network of providers from which you receive care, and many have premiums starting at $0/month. Some plans even offer a Giveback option, which provides reimbursement towards your Part B premium, as well as coverage for dental, hearing and vision. These plans do have copays, coinsurance, deductibles, etc.

If you are new to Medicare, it's important to also learn about Medicare Supplement plans before making a final decision.

Medicare Part D

Part D is coverage for prescription drugs. It is a federally funded program aimed to lower the costs of retail prescription drugs.

Medicare Part D plans are optional. However, even if you don't take prescription drugs at this time, you should still review options for Part D, because enrolling at a later date may result in late penalties for life.

For 2026, the maximum out-of-pocket costs for prescription drug coverage is $2,100.

Ways to get Part D coverage:

Enroll in a stand-alone Part D Plan offered by private insurers

Be enrolled in an employer sponsored drug plan

County Assistance office (Extra-Help Program)

VA Drug Coverage

What about the other 'parts' I hear about, like F and G?

That's a lot of 'parts' to consider, but what part do I actually need?

Technically, Medicare is not mandatory, but there will be lifetime penalties for enrolling into Medicare Parts A, B & D if not done on time.

However, if you are enrolled in creditable coverage, such as health insurance through a large employer (20+ employees), you can delay enrolling into Parts A and B, without lifetime penalties.

Part D is something most people need as well. You can purchase this as a stand-alone plan, or alongside a Medicare Advantage Plan or Medigap. If you are receiving prescription drug benefits as a Veteran, there are important key factors to review before enrolling into a Medicare Advantage or Medigap plan. Be sure to schedule a free consultation prior to making the decision to enroll into Part D.

READY WHEN YOU ARE

Your Health & legacy matters. Let’s protect it—together.

Why Choose Core Legacy Group?

Choosing a plan—whether for your health, Medicare, or your estate—isn’t just about forms—it’s about trust. At Core Legacy Group, we don’t just handle paperwork; we guide you through some of the most important decisions you’ll ever make for yourself and your loved ones.

You’re not rushed. You’re heard.

We’ve seen firsthand the confusion and stress that comes with planning for your health, Medicare, and your family’s future. That’s why our approach is different—personal, guided, and centered around you.

The Core Legacy Difference

Compassion-led guidance

Licensed, trusted professionals

Clear, personalized solutions

Education—not pressure

Choosing Core Legacy Group means choosing clarity today—and peace of mind for the people you love tomorrow.

Medicare Disclaimer:

Core Legacy Group and its licensed agents are independent insurance agents. We do not represent or are endorsed by the federal government or the Medicare program. We offer products from multiple insurance carriers. This website is for informational purposes only and is not a solicitation to enroll in a Medicare plan. For official Medicare information, visit www.medicare.gov.